I was having a little trouble finding the information I needed online, so I figured this might be a useful guide to others.

Oakland Business Tax

(Updated 02.14.2015)

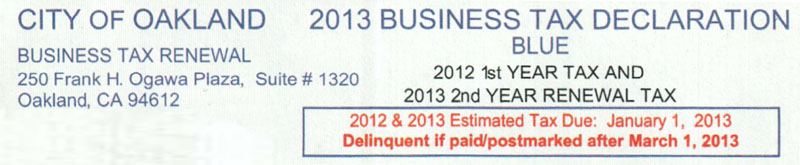

You can pay your City of Oakland Business Tax starting January 1 and the deadline for the previous year is March 1st. In this case, I was eligible to pay last year’s business tax between January 1st and March 1st of this year. You should have received a City of Oakland Tax Declaration Form in the mail.

If you pay after March 1st there are additional fees:

- Penalty of 10% if between March 3rd and May 1st

- Penalty of 25% if after May 1st

- Interest on the tax amount AND the penalty amount of 1% per month from March 3rd until it is paid

The form itself is pretty straightforward, however I noticed that there was a Small Business Exemption that I qualified for…

Small Business Exemption

The Small Business Exemption allows certain small business to be exempt from paying Oakland Business Tax. A business must apply every year for the exemption if it qualifies.

It applies to businesses with total annual gross receipts of $2700 or less (though the official website states this number is $2800, I believe $2800 is the correct amount for 2012-2015 as it appears the paper form is dated)

except for:

- Rental properties

- Corporate headquarters

- Taxicab companies/owners

The official website and tax declaration form have instructions for applying:

- Enter previous year total gross receipts on Line 13 of the declaration form

- Check box 4b on the declaration form

- Complete form IRS 4506T (Transcript request)

- Complete, sign and send the Declaration and 4506T form.

However, I found that I needed some clarity in filling out these forms, so I had to call the city business tax renewal department for more information.

How to fill out the forms if you qualify for the Small Business Exemption

Here’s what you need to do to fill out the forms. (Disclaimer: check with the City of Oakland if you are unsure; Follow these instructions at your own risk!)

City of Oakland Business Tax Declaration Form

- Check box 4b to indicate that you are claiming a Small Business Exemption.

- Line 13: Enter your Gross Receipts. For the previous year, this must be below $2800.

- Line 14: This is zero because you are claiming a Small Business Exemption.

- Line 15: Enter your estimated gross receipts for this year. Things are a little murky here – you can once again file for a Small Business Exemption for the year 2013, but I’m not sure exactly how to do it. The woman I spoke to on the phone informed me that most businesses don’t do this because they expect to gross more than $2800 in the current tax year.

- Line 16: This is a $60 minimum or a certain percent of your estimated gross receipts, depending on your business classification.

- Line 17: Self explanatory, add lines 14 and 16

- Line 25: Even if you claim the Small Business Exemption, you must add the $1 from line 24.

- Sign, date, and fill out your payment information.

You may also want to check out the official City of Oakland Business Tax FAQ.

IRS 4506T – Request for Transcript of Tax Return

Filling out this form is a little trickier because the City of Oakland doesn’t offer much documentation on what they want from this request for a transcript.

I talked to the Business Tax Office, and they informed me to do the following:

- Lines 1a, 1b: Enter your name and social security number. If you file jointly, also fill in 2a and 2b with information for your spouse.

- Line 3: Add your name and address

- Lines 4 and 5: Leave these blank. The City of Oakland will fill this out for you as needed.

- Line 6: Enter the tax form you file. This is probably your 1040 Schedule C form.

- Lines 6a, 6b, 6c, 7, 8: Leave these blank.

- Line 9: For the previous tax year, enter 12/31/yyyy.

- Sign and date.

The woman I spoke to on the phone recommended that the 4506T form be sent to the Business Tax office address:

City of Oakland Business Tax Section

250 Frank H. Ogawa Plaza, Suite 1320

Oakland, CA 94612

and the Tax Declaration Form be sent to:

City of Oakland Business Tax Section, Dept #34397

PO Box 39000

San Francisco, CA 94139

How to fill out the forms if you do NOT qualify for the Small Business Exemption

City of Oakland Business Tax Declaration form (green)

- Check box 4a only if you need to make any changes to your business information. Do you need to change your Mailing address, Business Name, Business Location, Phone number, Ownership type or owner names?

- Do not check box 4b, this is only if you can claim the Small Business Exemption

- Check box 4c only if you have discontinued or sold your business in the previous year or this year

- Check box 4d if your are apportioning your gross receipts. This means that some of your business has taken place outside of Oakland.

- Line 13: Report your gross receipts from the previous year. This is the “tax base” for the current year.

- Line 14: Multiple Line 13 by 0.0012. Put that number down UNLESS it is under $60. If that is the case, then put down $60. This is your tax due.

- Line 15: Penalty due: This only applies if you are paying after March 2nd of the calendar year. Hopefully this isn’t the case!

- Line 16: Interest due: This only applies if you are paying after March 2nd of the calendar year. Hopefully you don’t have to pay this either!

- Line 17: Prior amount due: If you still owe the City of Oakland money for business tax in previous years, put this down.

- Line 18: Failure to file fee: Add $50 if the City of Oakland has sent you notice that you are delinquent on your business tax. Hopefully you aren’t!

- Line 19: You must contribute $1 to the State Mandated Disability Access and Education Revolving Fund

- Line 20: Add lines 14-19 and see what you end up with.

- If you’re closing your business, fill out Section III.

- Then sign the form, put your phone number and date down.

- If paying by credit card, fill in your information and then mail the form back to the City:

CITY OF OAKLAND

Business Tax Section

PO Box 101515

Pasadena, California 91189-0005

I hope this helps. Once again, I’m not responsible if your taxes don’t come out right. You can call the Business Tax Office at 510-238-3704. They are open Monday through Friday from 8:00am to 4:00pm except for Wednesdays, where they are open from 9:30am to 4:00pm. They are closed on furlough days.